After deciding to start a partnership with the bank and becoming its client as a legal entity, I wanted to carefully explore the possibilities of connecting additional services necessary for solving everyday business tasks, such as accounting, sales, legal support, fundraising, and much more.

First Steps

Times are changing rapidly, and with them, our methods of doing business are changing. The modern period of digital transformation, import substitution, and innovation is accompanied by the active development of digital products, including the field of entrepreneurship. The introduction of artificial intelligence into remote services focused on supporting business processes makes them more efficient and incredibly useful for solving the current tasks of small businesses.

As a budding entrepreneur, I decided to realize my dream of starting a company in the catering service sector. The decision to start my small business seemed bold, but the desire to realize my ideas and apply the work experience I gained in employment to my own business filled me with determination. There were many questions: how to manage finances, organize accounting, and establish interaction with counterparties?

One of the first and most important steps is to open a current account for doing business. As a VTB client as an individual, when choosing a bank to open a current account, I paid attention to its line of financial products and services.

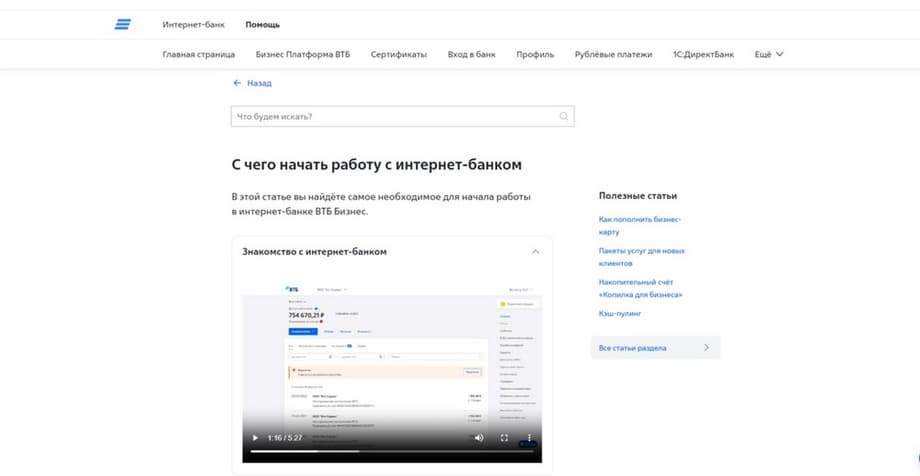

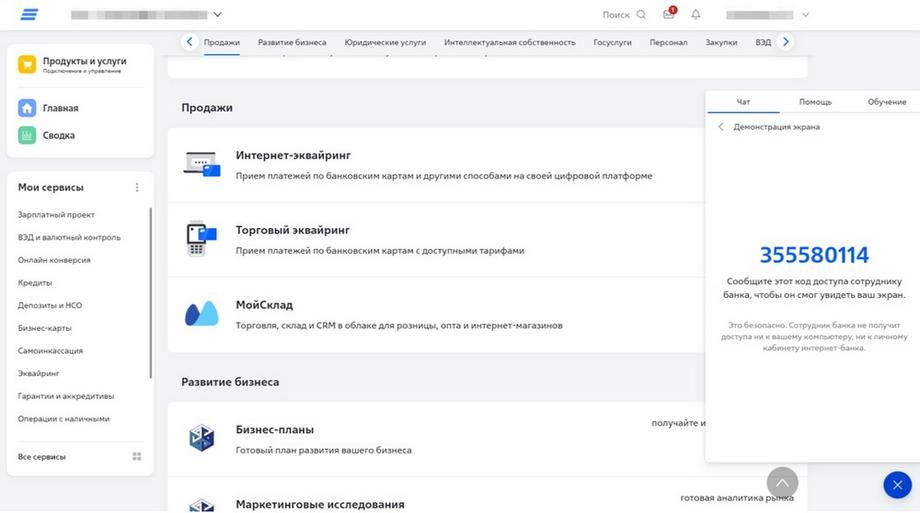

To begin with, I decided to familiarize myself with the interface of the VTB Business Platform to determine how well it meets my needs. An initial acquaintance with the demo version of the online bank made it clear that working with the personal account is not difficult, and I will be able to figure everything out on my own.

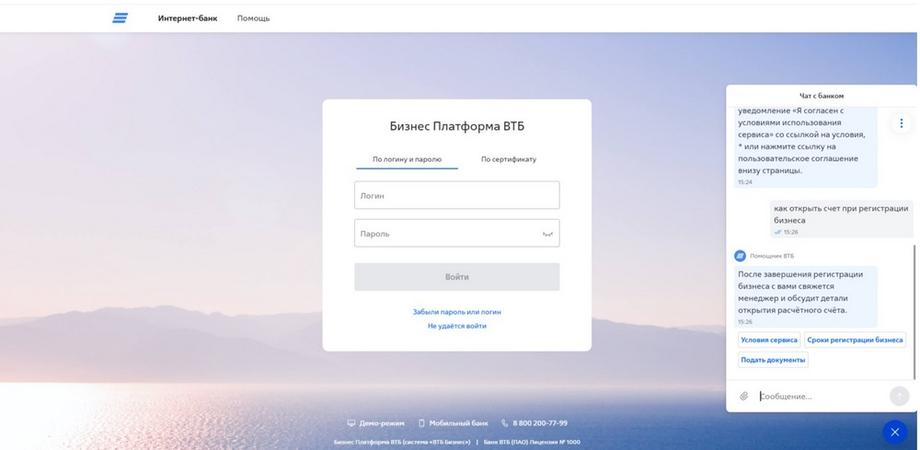

I had no experience opening a current account for business, so I decided to clarify the details through the chat, which is available on the authorization page.

In the chat, I received the necessary advice on the account opening process. It turned out that everything can be done remotely – through the bank's on-site service. This experience turned out to be much simpler than I expected. On the online bank's website, I uploaded the necessary documents online, avoiding the inconvenience and long waits in queues at the branch. Shortly after receiving the documents I uploaded, a representative of the on-site service contacted me, and I successfully opened a current account, gaining access to the online bank.

First Experience Using a Digital Platform for Business

Mastering the basic functions of the VTB Business Platform, such as transfers and bill payments, was an important step. Doing my own accounting and spending a lot of time on it (I didn't know about the convenient remote accounting services in the Business Platform yet, but more on that later!), I wanted to make sure that mastering the new functionality didn't take much time and didn't interfere with focusing on business development.

I was pleasantly surprised that the traditional voluminous text instructions were replaced by interactive guides and training videos, which are available directly from the login page without authorization.

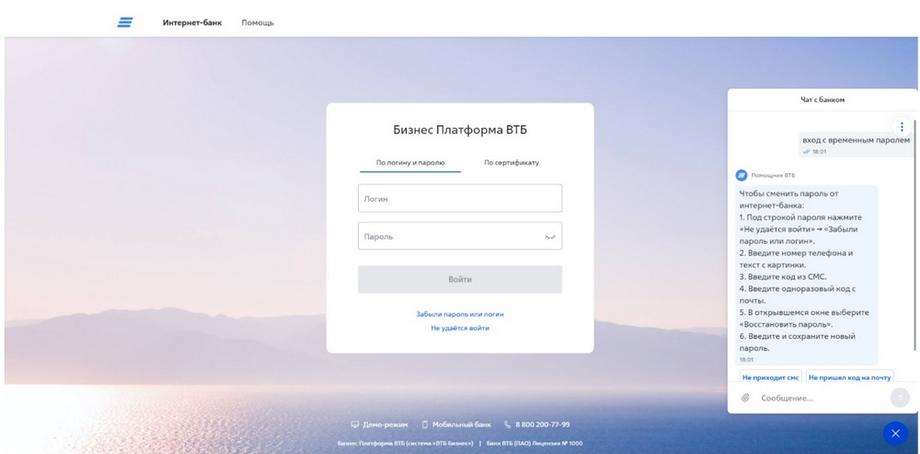

Before the first login, I was given a temporary password, and I immediately decided to find out how to set a permanent password, and the chatbot already had an answer ready.

My experience confirmed that working with modern banking services for business is no more difficult than when I performed operations in the online bank as an individual.

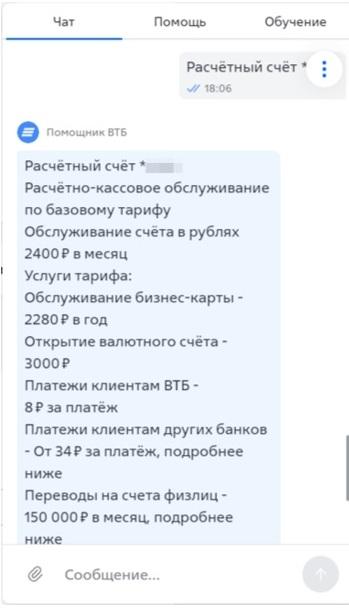

In the personal account of the online bank, I decided to clarify the service conditions and my tariff. The bot in the chat immediately processed my request, providing the necessary information in detail.

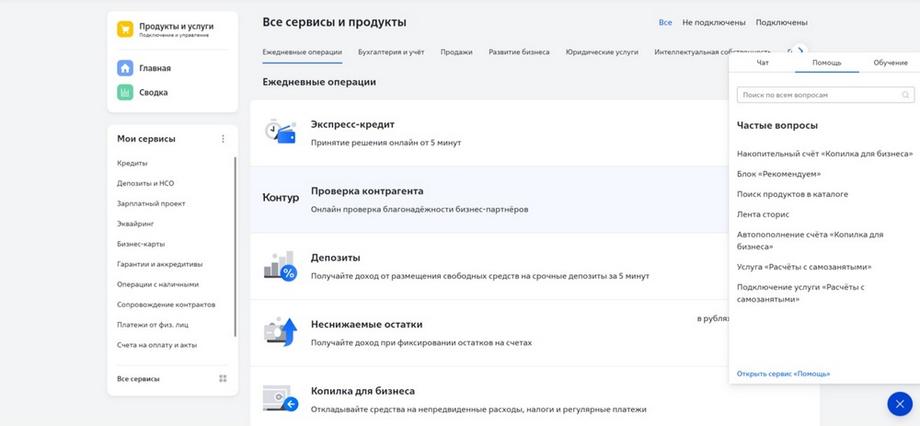

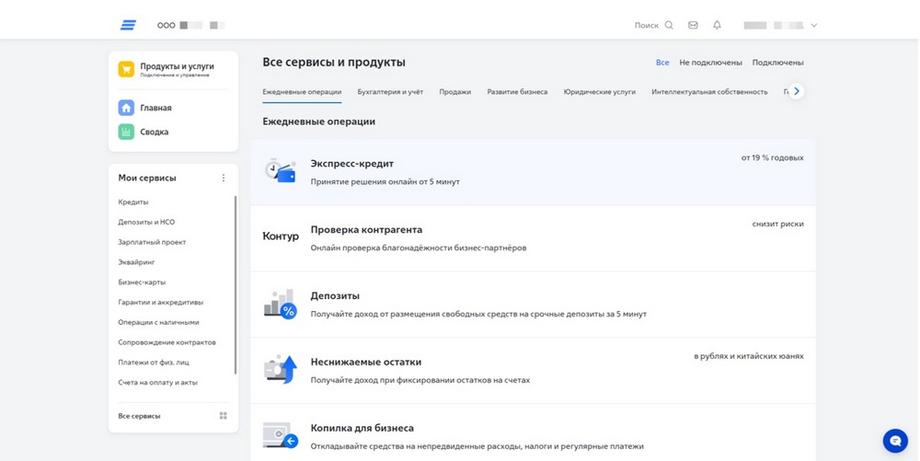

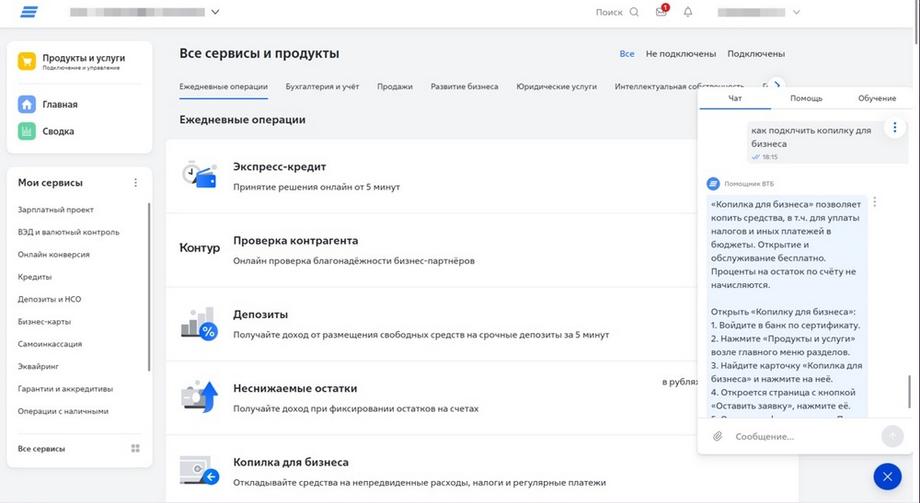

After deciding to start a partnership with the bank and becoming its client as a legal entity, I wanted to carefully explore the possibilities of connecting additional services necessary for solving everyday business tasks, such as accounting, sales, legal support, fundraising, and much more.

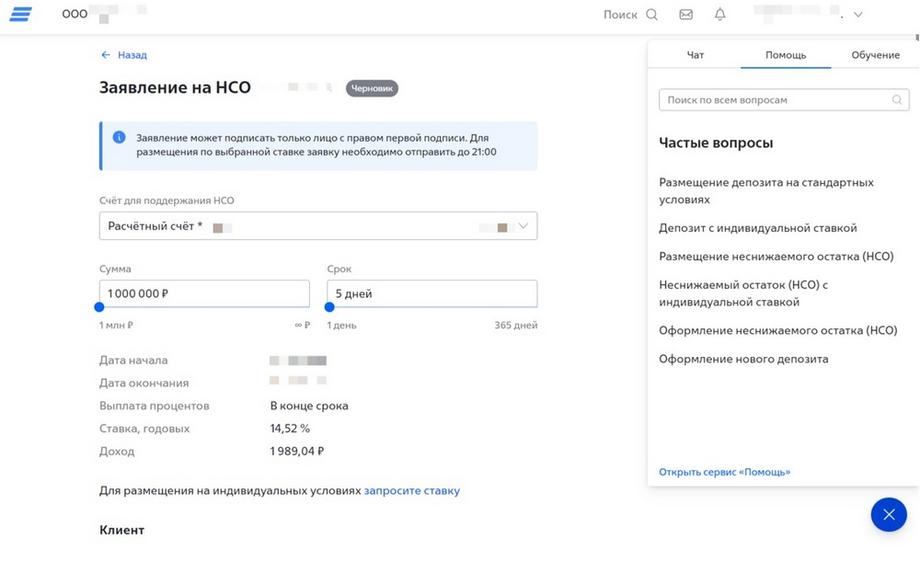

The ability to issue the "Non-Reducing Balance" product in three clicks attracted my attention, because with its help I was able to receive additional income in the form of interest on the balance in the current account by placing temporarily available funds.

Then I continued to study the products available to me that are relevant to my business.

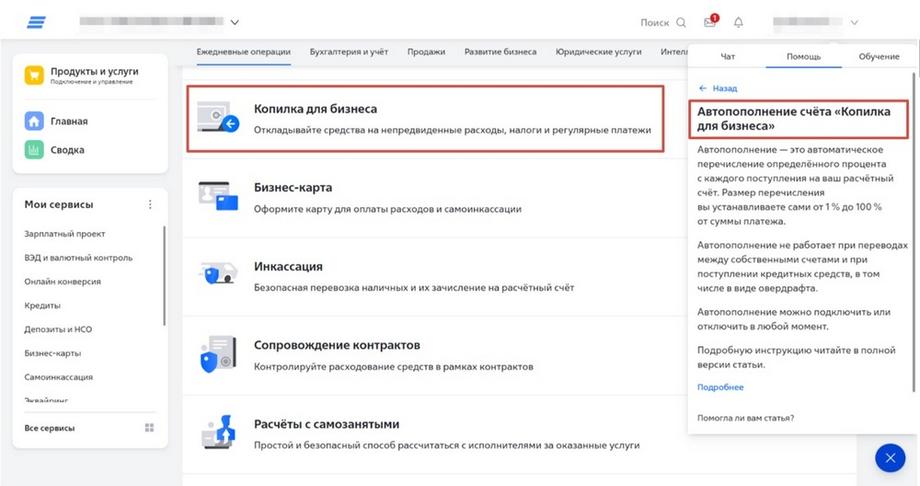

In the process of searching for optimal solutions for my business, I had various questions, but getting additional information turned out to be as simple as possible – when opening the "Help" tab in the VTB Business Platform chat, understanding my needs, it immediately selected the necessary reference information for me:

The online bank's chatbot immediately gave a detailed answer on the processes of connecting the services I was interested in, understanding my requests even taking into account the presence of typos in them:

To solve the problem, I only had to perform a few simple steps described in the chat. In general, in the process of working with the VTB Business Platform, I periodically had various questions about the service: at the same time, the bot always accurately recognized their meaning and instantly gave a relevant detailed answer.

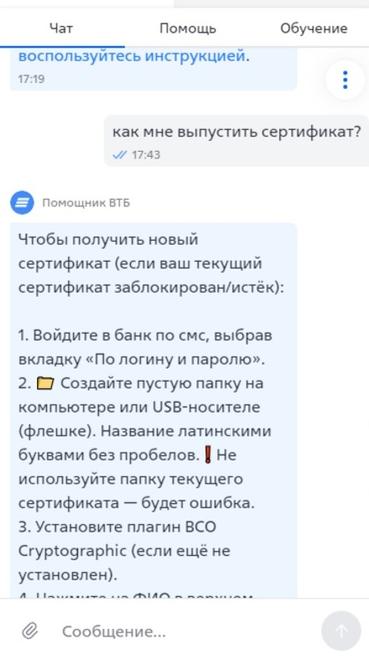

For example, when the need arose to issue a certificate, I received all the necessary information in the chat without having to contact the support service, thereby saving my time.

If earlier I preferred to solve all issues THROUGH THE BANK'S CONTACT CENTER OPERATOR, contacting support by phone, but after getting acquainted with the convenience and functionality of the VTB Business Platform, I gradually changed this approach, preferring to solve the issue in the format of correspondence in the chat. Moreover, in this way I had the entire history of my requests at hand, and if necessary, I could review the chat history and not ask the same questions repeatedly. Previously, in the process of receiving advice by phone, it was easier for me to show the screen TO THE BANK EMPLOYEE instead of describing in words the question I had about the system interface. In some cases, this is still convenient, but it is faster and easier to find out something in the chat, which seems to know the answer to any question!

Conclusion

My experience with the VTB Business Platform turned out to be simple and useful for a budding entrepreneur. Opening an account, making transactions, and receiving advice using a chatbot have changed my perception of the quality of modern digital financial platforms and tools for business. The ecosystem of a modern online bank and intelligent user support services greatly simplify the launch of your business, becoming a reliable assistant for a starting business.

Now on home