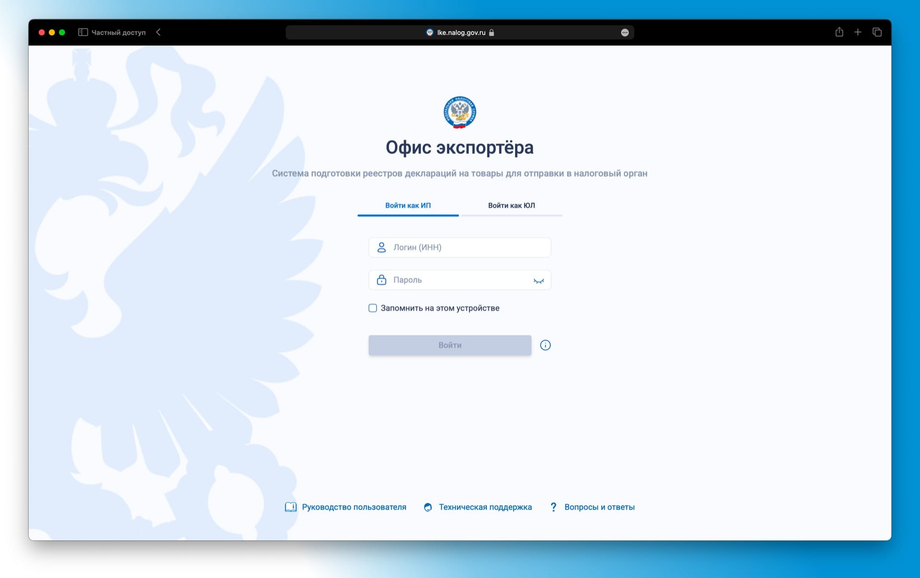

The Federal Tax Service has launched a new feature in the "Exporter's Office" service. The new register contains information from declarations for goods, documents for their payment, warehouse lease agreements, or other documents. It can also be sent to the tax authorities directly from the service.

As explained by the agency, this register simplifies the procedure for confirming the zero VAT rate when selling goods in foreign countries for residents of the Russian Federation. The Federal Tax Service noted:

Thus, taxpayers who previously exported goods and now sell them to individuals from a warehouse (from premises) located in a foreign country (except for the EAEU), from the 1st quarter of 2025, are required to confirm the 0% VAT rate with a register in electronic form (KND 1155223).

The form, procedure for filling it out, and format of such a register are available with the XSD schema on the tax service's website.